Follow these steps to get started.

Step 1. OBTAIN A COPY OF YOUR OWN CREDIT REPORT HISTORY AND STUDY IT.

Learn the process. Order copies of your credit reports from Annual Credit Report.com or directly from each credit bureau Equifax, Experian or Trans Union. Review each for errors and compose a list, along with an explanation of each error. Dispute said errors with each credit agency reporting the erroneous items. In addition, contact each creditor and request the items be reported correctly.

Step 2. LEARN AS MUCH AS YOU CAN ABOUT THE CREDIT REPAIR REGULATIONS.

Determine licensing and bonding requirements. Laws differ in jurisdictions, but in general, a credit repair business has to apply for and obtain a occupational license. In addition, seek a surety bond with a bonding agency. Typically, credit repair businesses must bonded to legally operate. Check with your state’s department of business regulation for the specifics of each requirement.

Also setup and create your agreements and disclosures such as:

Credit Repair Service Agreement

Client Credit File Rights and Disclosures

Power of Attorney

Authorization to Obtain Credit Reports

Notice of Cancellation

Step 3. GET YOUR FIRST CLINT

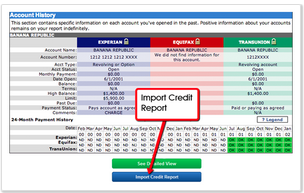

Once you get your clients credit reports, you can then identify negative items that impact your clients credit score and work with that client to correct any mistakes.Credit repair involves sending out dispute letters to the credit bureaus or creditors to requesting verification. You clint has the right to dispute inaccurate or incomplete information in your credit report. The credit reporting agency must comply within 30 days.

Step 4. EXPLAIN THE PROCESS TO YOUR CLIENT AND KEEP UP WITH YOUR PROMISES

A credit repair company cannot “erase” negative items that are accurate and have been present on a credit report for less than seven years. However, many accurate but negative items can be removed with a bit of finesse if you learn the right negotiating tactics and approach the creditors and collection agencies in the proper manner.

Here’s the good news: 79% of all credit reports contain errors. This means that MOST credit reports contain errors. Those errors come off very easily with a few clicks of your mouse. Simply removing errors will improve a score almost immediately. Once you’ve accomplished that, you can further enhance a credit report by negotiating the remaining negative items.

Step 5. MINIMIZE YOUR TIME SPENT BY WORKING SMART AND ORGANIZED

The most common mistake more entrepreneurs make is in managing their time poorly. Time spent creating dispute letters and handling paperwork can eat up hundreds of hours and drop your hourly earnings very low. This is where software comes in handy. It can help you to work “smart” by saving you hundreds of hours by automating the process and giving you more off-time to enjoy your success.

Step 6. PROMOTE AND MARKET YOUR CREDIT REPAIR SERVICE

Market your credit repair business. Create and publish a website that contains your mission statement, a summary about the credit repair process, a schedule of fees and your business’ contact information. Use social networking sites and pay-per-click ad campaign to drive traffic to your website and distribute fliers in local shopping mall parking lots. Purchase print and radio advertising to target local consumers.

Step 7. START SLOWLY AND GET RESULTS FOR ONE CLIENT BEFORE TAKING ON MANY CLIENTS

As a credit consultant, you should start to build your business locally before expanding too fast or going to the internet. If you build your credibility early, when you branch out, you will have experience and a history of customer satisfaction to back you up.

Stay honest with your clients and never guarantee what you cant do. Take time to explain your clients how the process works and what should they expect so your clients can trust you and your business, after all you are providing them with a very important and personal service.

This will increase your credibility and also generate more business by word of mouth.

Step 8. CREDIT REPAIR SOFTWARE

Starting a credit repair business can be made much simpler with the help of Professional Credit Repair Software. TurboDispute is Web-Based Credit Repair Software with all the tools needed to start, run and manage a Credit Repair Business! Automatically import your clients Credit Reports , Automated dispute letters, client and affiliate portal, multi-user and fully customizable. Manage your entire credit repair business from anywhere. For more information about credit repair software visit www.turbodispute.com or call 1-877-824-1121 for a free consultation. Be sure to ask about our current specials!

If you are looking to start a credit repair business, here are some ideas from folks having success with our software. Credit-Repair Business methods for revenue and here is our recommended software for starting a credit repair business.